27

A Vote “For” Proposal 2.

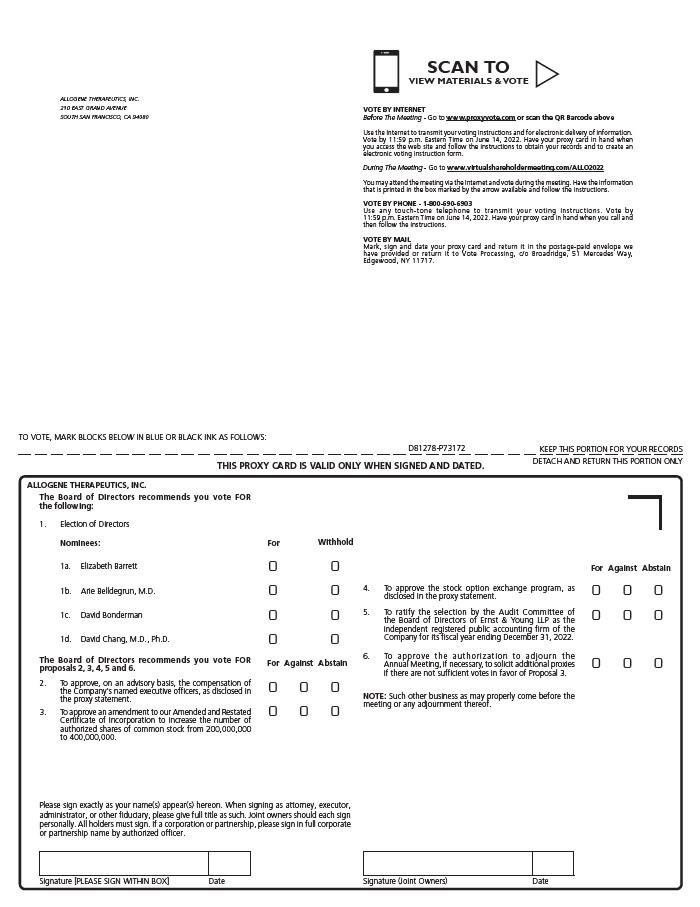

Proposal 3

Approval of the Increase in Number of Authorized Shares of Common Stock

GeneralExecutive Officers

The Board has approved an amendment (the “Authorized Shares Amendment”) to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to increase the number of authorized shares of common stock from 200,000,000 to 400,000,000. The Authorized Shares Amendment will not change the number of authorized shares of preferred stock, which currently consists of 10,000,000 shares of preferred stock.

The additional shares of common stock authorized for issuance by the Authorized Shares Amendment would be a part of the existing class of common stock and, if and when issued, would have the same rights and privileges as the common stock presently issued and outstanding. The full text of the proposed Authorized Shares Amendment is attached to this Proxy Statement as Appendix A. However, the text of the Authorized Shares Amendment is subject to revision to include such changes as may be required by the Secretary of State of the State of Delaware and as deemed necessary and advisable to effect the Authorized Shares Amendment.

Provided the stockholders approve the Authorized Shares Amendment, the increased number of shares would be authorized for issuance, but would remain unissued until such time as the Board approves a specific issuance of such shares. Other than future issuances under the Company’s equity compensation plans and issuances of common stock that may be issued and sold under our Common Stock Sales Agreement with Cowen and Company, LLC ($167.3 million of common stock remains available for sale under such agreement as of December 31, 2021), the Company currently has no plans or arrangements to issue the additional authorized shares of common stock that will result in the event that the Company’s stockholders approve, and the Company implements, the Authorized Shares Amendment.

Adoption of the Authorized Shares Amendment would not affect the rights of the holders of currently outstanding common stock, except for effects incidental to increasing the number of shares of our common stock outstanding, such as dilution of the earnings per share and voting rights of current holders of common stock, to the extent that any additional shares of common stock are ultimately issued out of the increase in authorized shares proposed in the Authorized Shares Amendment.

If the proposed Authorized Shares Amendment is approved by the requisite vote of the stockholders, it will become effective upon the filing of a Certificate of Amendment with the Secretary of State of the State of Delaware. The Board reserves its right to elect not to proceed with and abandon the Authorized Shares Amendment if it determines, in its sole discretion at any time, that this proposal is no longer in the best interests of our stockholders.

If we fail to obtain stockholder approval of this proposal at the Annual Meeting, we may continue to seek to obtain stockholder approval at each subsequent annual meeting of stockholders and/or special meetings of stockholders until such approval has been obtained and we will incur the costs associated therewith.

Background

In addition to the 143,569,902 shares of common stock outstanding on March 31, 2022, we have also reserved, as of March 31, 2022, 22,567,690 shares for issuance upon the exercise or vesting of outstanding stock awards and 19,889,713 shares for issuance pursuant to the Company’s equity incentive and employee stock purchase plans, meaning that we presently have 13,972,695 authorized shares available for issuance, which is insufficient to meet our needs in connection with future financings or strategic transactions and properly incentivizing our key personnel.

Purposes and Effects of the Authorized Shares Amendment

The Board is recommending the proposed increase in the authorized number of shares of common stock to provide the Company with appropriate flexibility to issue additional shares in the future on a timely basis if such need arises in connection with potential financings, business combinations or other corporate purposes. Approval of the Authorized Shares Amendment could enable the Company to take advantage of market conditions, the availability of more favorable financing, and opportunities for business combinations and other strategic transactions, without the potential delay and expense associated with convening a special stockholders’ meeting.

Our success also depends in part on our continued ability to attract, retain and motivate highly qualified management and key personnel. If this proposal is not approved by our stockholders, the lack of unissued and unreserved authorized shares of common stock to provide future equity incentive opportunities could adversely impact our ability to achieve these goals. In short, if our

stockholders do not approve this proposal, we may not be able to access the capital markets, complete corporate collaborations or partnerships, attract, retain and motivate employees, and pursue other business opportunities integral to our growth and success.

The proposed increase in the number of authorized shares of common stock will not, by itself, have an immediate dilutive effect on our current stockholders. However, if this proposal is approved, unless otherwise required by applicable law or stock exchange rules, the Board will be able to issue the additional shares of common stock from time to time in its discretion without further action or authorization by the stockholders. The newly authorized shares of common stock would be issuable for any proper corporate purpose, including capital raising transactions of equity or convertible debt securities, the establishment of collaborations or other strategic agreements, stock splits, stock dividends, issuance under current or future equity incentive plans, future acquisitions, investment opportunities, or for other corporate purposes. The future issuance of additional shares of common stock or securities convertible into our common stock may occur at times or under circumstances that could result in a dilutive effect on the earnings per share, book value per share, voting power and percentage interest of the present holders of our common stock, some of whom have preemptive rights to subscribe for additional shares that we may issue.

Potential Anti-Takeover Effect

An increase in the number of authorized but unissued shares of common stock relative to the number of outstanding shares of common stock may also, under certain circumstances, be construed as having an anti-takeover effect. Although not designed or intended for such purposes, the effect of the Authorized Shares Amendment might be to render more difficult or to discourage a merger, tender offer, proxy contest or change in control of us and the removal of management, which stockholders might otherwise deem favorable. For example, the authority of the Board to issue common stock might be used to create voting impediments or to frustrate an attempt by another person or entity to effect a takeover or otherwise gain control of us because the issuance of additional common stock would dilute the voting power of the common stock then outstanding. Our common stock could also be issued to purchasers who would support the Board in opposing a takeover bid which our Board determines not to be in our best interests and those of our stockholders. In addition to the Authorized Shares Amendment, the Certificate of Incorporation and Amended and Restated Bylaws also include other provisions that may have an anti-takeover effect. These provisions, among other things, permit the Board to issue preferred stock with rights senior to those of the common stock without any further vote or action by the stockholders, provide that special meetings of stockholders may only be called by the Board and some of our officers, and do not provide for cumulative voting rights, which could make it more difficult for stockholders to effect certain corporation actions and may delay or discourage a change in control. The Board is not presently aware of any attempt, or contemplated attempt, to acquire control of the Company and the Authorized Shares Amendment is not part of any plan by the Board to recommend or implement a series of anti-takeover measures.

Vote Required

Approval of this proposal requires the affirmative vote of a majority of the shares of our common stock outstanding on the record date for the Annual Meeting. Abstentions will have the same effect as an “against” vote on this proposal. As noted above, we believe that this proposal will be considered a “routine” matter and, as a result, we do not expect there to be any broker non-votes on this proposal. If, however, a broker non-vote occurs (or if your shares are not affirmatively voted in favor of this proposal for any other reason), it will have the same effect as an “against” vote on this proposal.

The Board of Directors Recommends

A Vote “For” Proposal 3.

Proposal 4

Approval of the Stock Option Exchange Program

On April 13, 2022, our Board authorized a stock option exchange program (the “Option Exchange”) pursuant to which our eligible employees would be given the opportunity to exchange eligible stock options for new stock options with an exercise price equal to the fair market value of our common stock at the time of the exchange. An eligible stock option generally includes any employee stock option that has an exercise price equal to or greater than $18.00 per share and was granted on or prior to December 31, 2021 pursuant to our 2018 Amended and Restated Equity Incentive Plan (the “2018 Plan”).

As of March 31, 2022, we had outstanding stock options held by employees to purchase 6,654,366 shares of common stock with a weighted average exercise price of $19.36 per share (exclusive of the Excluded Employees as defined below). Of these employee stock options, there were 4,070,873 shares with an exercise price equal to or greater than $18.00 per share with a weighted-average exercise price of $26.78 that would be considered eligible stock options for purposes of the Option Exchange.

The Board believes that the Option Exchange is in the best interests of stockholders and the Company, as new stock options granted under the program will provide added incentive to motivate and retain our talented employees.

Rationale for Option Exchange

We evaluated several alternatives for remaining competitive within our industry and with our employees, including increasing cash compensation and/or granting additional equity awards. While these components are part of our overall compensation packages, we do not believe that relying exclusively on such approaches is an ideal use of our resources. For example, increasing cash compensation would reduce the cash resources we devote to research and development, and granting additional stock awards would cause dilution to our current stockholders and greater expense. Accordingly, we determined that the Option Exchange was the most attractive alternative for stockholders for the reasons set forth below.

Employee Retention, Motivation and Performance

We have designed the Option Exchange to restore equity value, increase retention and motivation in a competitive labor market, provide non-cash compensation incentives and align our employee and stockholder interests for long-term value creation. Underwater stock option awards are of limited benefit in motivating and retaining our employees. Through the Option Exchange, we believe that we will be able to enhance long-term stockholder value by increasing our ability to retain experienced and talented employees and by aligning the interests of these individuals more fully with the interests of our stockholders.

Because 61% of our eligible employee stock options are underwater (and for a large number of employees, significantly so), as of March 31, 2022, we may face a considerable challenge in retaining our employees and there is a possibility that our competitors may be able to offer equity incentives that are more attractive, which in some cases, could make the terms of employment at a new employer more attractive than we can offer to our existing employees. Additionally, the underwater options have less perceived value and are unlikely to incentivize employees to work harder and build up value in the Company. The Option Exchange is designed to address these concerns, improve morale among our employees generally and reinvigorate a culture where equity compensation is a key component of our overall compensation package.

As discuss in more detail below, none of the new stock options issued under the Option Exchange program will be vested on the date of grant. Stock options issued in the Option Exchange will vest in equal annual amounts over a three-year period from the grant date of such new stock options. The stock options eligible to be exchanged are generally subject to a four-year vesting schedule, in which twenty-five percent of shares vest after one year, and the remaining shares vest in equal monthly installments. Our Compensation Committee believes that implementing a new extended vesting schedule is appropriate because it encourages retention of employees over the next three years, during a highly critical period for the Company.

Impact on Compensation Expense

The “fair value” of the stock options eligible for exchange was based on the then fair market value of our common stock on the applicable grant date. Under applicable accounting rules, we will recognize a total of approximately $73.9 million in non-cash compensation expense related to these underwater stock options, $36.3 million of which has already been expensed as of December 31, 2021 and $37.6 million of which we will continue to be obligated to expense, even if these stock options are never exercised because they remain underwater. Assuming that the exercise price of the replacement options will be equal to $9.11 per share (which was the fair market value of our stock on March 31, 2022), the replacement took effect on March 31, 2022 and all eligible employees participate, and that the inputs for the Black Scholes option pricing model used are held constant, the replacement options will result in an additional non-cash compensation expense of approximately $8.7 million. By replacing current stock options that have little or no

retention or incentive value with new stock options that will provide both retention and incentive value while being mindful of the additional compensation expense, we believe that we will be making efficient use of our resources.

Alternatives Considered

Our Compensation Committee considered alternatives to the Option Exchange to provide meaningful performance and retention incentive to our employees, including providing new equity to employees, repricing the options with no change in vesting, exchanging underwater options for full value shares, or increasing cash compensation. The Compensation Committee determined that the Option Exchange provides better performance and retention incentives with less cost to the Company or dilution to stockholders than the other alternatives.

Structure of the Option Exchange

The Board authorized the Option Exchange on April 13, 2022, subject to stockholder approval. It is currently anticipated that the Option Exchange will commence as soon as reasonably practicable following approval of this Proposal 4 by our stockholders, or the Commencement Date. At the start of the Option Exchange, employees holding eligible stock options will receive a written exchange offer that will set forth the precise terms of the Option Exchange. The written offer will be governed by the tender offer rules of the SEC. At or before the Commencement Date, we will file the offer to exchange and other related documents with the SEC as part of a tender offer statement on Schedule TO. Eligible optionholders will be given at least 20 business days to elect to participate in the Option Exchange. Eligible optionholders must choose to participate in the program for all of their eligible options or none, and may not choose to exchange portions of eligible option grants or some eligible option grants and not others. Set forth below is a descriptionbiographical information for each of the key features of the Option Exchange.

Eligible Participants

The Option Exchange will be available to employees, excluding our executive officers other than Dr. Chang, whose biographical information is set forth above.

Earl Douglas, 61, has served as the Company’s Senior Vice President, General Counsel and Compliance Officer since August 2023 and as our Corporate Secretary since January 2024. Before joining Allogene, Mr. Douglas served as Executive Vice President, General Counsel of Applied Molecular Transport. Prior to that role, he served in the same capacity for Kiverdi, Inc. He has also served as Vice President, General Counsel at BioMimetic Therapeutics, Spinal Dynamics, and OPX Biotechnologies. He previously served as Counsel with Wilson Sonsini Goodrich & Rosati, and earlier in his career practiced as an Associate with Weil, Gotshal & Manges. He earned his B.S. in chemical engineering from the Massachusetts Institute of Technology (MIT) and his J.D. from Columbia University School of Law.

Timothy Moore,62, has served as our Executive Vice President, Chief Technical Officer since April 2023. Previously, Mr. Moore served as the Chief Operating Officer of Instil Bio from September 2022 to December 2022, President and Chief CommunicationsOperating Officer (collectively,at PACT Pharma, Inc. from April 2020 to July 2022, and as the "Excluded Employees"), who on the Commencement Date are employed by usPresident and hold outstanding eligible stock options. AsChief Technology Officer at PACT from October 2019 to April 2020. Prior to PACT, Mr. Moore served as Executive Vice President, Technical Operations of Kite Pharma, or Kite, a Gilead Company, from March 31, 2022, eligible stock options were held by approximately 71%2016 to September 2019. Prior to Kite, he spent more than 12 years at Genentech, a Roche Company, most recently as Senior Vice President, Head of employees (exclusiveGlobal Technical Operations – Biologics and as a member of the Excluded Employees). ParticipantsGenentech Executive Committee. He holds a B.S. in Chemical Engineering from Tulsa University and an M.S. from Northwestern University.

Geoffrey Parker, 59, has served as our Executive Vice President, Chief Financial Officer since October 2023. Prior to joining us, Mr. Parker served as Chief Operating Officer, Chief Financial Officer and Executive Vice President of Tricida, Inc. Prior to joining Tricida, Mr. Parker served as Chief Financial Officer of Anacor Pharmaceuticals, and served as a Partner and Managing Director at Goldman Sachs, where he led the Option Exchange must continue to be employed by and provide services to us onWest Coast Healthcare Investment Banking group. In addition, Mr. Parker currently serves as a member of the date the surrendered options are cancelled and replacement stock options are granted. Any employee holding eligible stock options who elects to participate in the Option Exchange but whose service with us terminates for any reason before the date the new stock options are granted, includingboard of directors of Perrigo Company plc. He earned a termination due to voluntary resignation, retirement, involuntary termination, layoff, death or disability, would retain his or her eligible options subject to their existing terms and will not be eligible to receive new stock options in the Option Exchange.

Eligible Stock Options

An eligible stock option generally includes any eligible employee stock option that has an exercise price equal to or greater than $18.00 per share and was granted on or prior to December 31, 2021. The $18.00 price threshold represents an approximately 200% premium to the volume weighted average stock price for 30 trading days through April 13, 2022. As of March 31, 2022, we had outstanding eligible stock options to purchase 4,070,873 shares of common stock under the 2018 Plan at a weighted-average exercise price of $26.78 per share andB.A. with a weighted-average remaining lifedouble major in Economics and Engineering Sciences from Dartmouth College and an MBA from the Stanford Graduate School of 7.9 years. These eligible stock options represent approximately 2.8%Business.

Zachary Roberts, M.D., Ph.D.,46, has served as our Chief Medical Officer since April 2023 and as our Executive Vice President, Research and Development since January 2023. Previously, Dr. Roberts served as Chief Medical Officer for Instil Bio, Inc. (“Instil”) from March 2020 to November 2022. Prior to joining Instil, he served in various roles for Kite, during his four-year tenure, with his last position as Vice President, Clinical Development from February 2018 to May 2019. Prior to joining Kite, Dr. Roberts served in various roles in Amgen, with his last position as Clinical Research Medical Director for Amgen Oncology from January 2015 to July 2015. Dr. Roberts completed his training in internal medicine and hematology/oncology at the Massachusetts General Hospital and Dana Farber Cancer Institute. He earned his B.S. in microbiology and immunology from the University of Maryland, College Park and both his Ph.D. in immunology and his M.D. from the issued and outstanding sharesUniversity of our common stock as of March 31, 2022.Maryland, Baltimore.

Exchange Ratio

The Option Exchange is a one-for-one exchange. Thus, each eligible option will be replaced by a new option covering the same number of shares, but with a new exercise price, term, and vesting schedule. The overall number of stock options will stay the same.

Vesting Schedules for New Options

New stock option awards will not be vested on the date of grant. Eligible stock options may be exchanged for new stock options with a new three-year vesting schedule, in each case vesting in equal annual installments over the vesting term. These new vesting schedules support the nature of stock options as an incentive vehicle and provide us with valuable additional years of employee retention during a highly critical time for the Company.

Term for New Options

The new stock options will expire seven (7) years following the date the new options are granted.

Discussion of the Option Exchange As Soon As Practicable Following Stockholder ApprovalNamed Executive Officer Compensation

We expect that the Option Exchange will begin as soon as reasonably practicable, but no later than four (4) months following stockholder approval, if received. Our Board in its discretion reserves the right to amend, postpone or, under certain circumstances, cancel the Option Exchange once it has commenced, but the Option Exchange will not be materially amended inare a manner more beneficial to eligible participants without first seeking additional stockholder approval.

Impact of Option Exchange on Surrendered Options

Under the terms of the Option Exchange, there will be no shares returned to the share reserve of the 2018 Plan because it will be a one-for-one exchange.

Option Exchange Process

Additional information about how we expect to conduct the Option Exchange, if approved by stockholders, is set forth below. While the terms of the Option Exchange are expected to conform to the material terms described above in this Proposal 4, we may find it necessary or appropriate to change the terms of the Option Exchange to take into account our administrative needs, accounting rules, company policy decisions or to comply with any comments we receive from the SEC. We may decide not to implement the Option Exchange even if stockholder approval of the Option Exchange is obtained, or we may delay, amend or terminate the Option Exchange once it is in progress. The final terms of the Option Exchange will be described in the exchange offer documents that will be filed with the SEC and available at www.sec.gov.

Overview of the Option Exchange Process

Upon commencement of the Option Exchange, eligible participants holding eligible stock option awards will receive a written offer setting forth the terms of the Option Exchange and may voluntarily elect to participate. All eligible employees who are employed by us on the Commencement Date, are still employed by us on the grant date of the new stock options, and hold eligible stock option awards may participate in the Option Exchange. Eligible participants will be given at least 20 business days to elect to surrender eligible stock options in exchange for the same number of new stock options. Upon completion of the Option Exchange, surrendered stock options will be cancelled and new stock options will be granted. Cancelled options will then be available for future grantSmall Reporting Company under the 2018 Plan.

The 2018 Plan will govern all terms or conditions of new stock options not specifically addressed by the Option Exchange described in this proxy statement. Additionally, it is anticipated that new options will be incentive stock options (that is, they will qualify for the tax-favored treatment) to the extent allowable under Section 422 of the Internal Revenue Code and available for grant under our 2018 Plan.

Election to Participate

Eligible participants will receive a tender offer document and will be able to voluntarily elect to participate in the Option Exchange. If you are both a stockholder and employee holding stock options that are potentially subject to the Option Exchange, note that voting to approve the Option Exchange does not constitute an election to participate in the Option Exchange. The written exchange offer documents described above will be provided if and when the Option Exchange is commenced, and you can only elect to participate after that time.

Impact of Option Exchange on Number of Options Issued

The Compensation Committee established a 1-to-1 exchange ratio, that will result in the issuance of the same number of stock options through the Option Exchange.

Effect on Stockholders

Under the terms of the Option Exchange, the new stock options will have an exercise price commensurate with their fair market value at the time of the Option Exchange, making the stock options no longer underwater. As stated in the “Rationale for Option Exchange” Section, these new stock options should help keep our valuable employees at our Company and motivate them to create long-term value for our Company and stockholders.

Interests of Our Executive Officers and Non-Employee Directors in the Option Exchange

The Excluded Employees and our non-employee directors (including our Executive Chair) will not be permitted to participate in the Option Exchange.

Accounting Impact

The incremental compensation cost associated with the Option Exchange will be measured as the excess, if any, of the fair value of each award of new stock option granted to participants in the Option Exchange, measured as of the date the new stock options are granted, over the fair value of the stock options surrendered in exchange for the new stock options, measured immediately prior to the cancellation. This incremental compensation cost will be recognized ratably over the vesting period of the new stock options.

Material U.S. Federal Income Tax Consequences of the Option Exchange

The exchange of stock options pursuant to the Option Exchange should be treated as a non-taxable exchange because the new stock options will have an exercise price equal to or greater than the fair market value of our common stock on the grant date. Neither the Company, nor participants in the Option Exchange, should recognize any income for U.S. federal income tax purposes upon the grant of the new stock options. To the extent permissible and available for grant under our 2018 Plan, new stock options granted under the Option Exchange will be incentive stock options for U.S. federal income tax purposes. Tax effects may vary in other countries; a more detailed summary of tax considerations will be provided to all participants in the Option Exchange documents.

Financial Statements

Our consolidated financial statements and other information required by Item 13(a) of Schedule 14A under the Exchange Act are incorporated by reference from our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on February 23, 2022.

Vote Required

Approval of the Option Exchange requires “For” votes from a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote on this proposal. Abstentions will have the same effect as an “Against” vote on this proposal. Broker non-votes will have no effect.

If you are both a stockholder and an employee holding eligible stock options, please note that voting to approve this program does not constitute an election to participate in the program.

Our Recommendation

The Board of Directors Recommends

A Vote “For” Proposal 4.

Proposal 5

Ratification of Selection of Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has selected Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 and has further directed that management submit the selection of its independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Ernst & Young LLP has audited the Company’s financial statements since its inception in 2017. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’s Bylaws nor other governing documents or law require stockholder ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm. However, the Audit Committee of the Board is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present at the Annual Meeting or represented by proxy and entitled to vote on the matter at the Annual Meeting will be required to ratify the selection of the accounting firm. Abstentions will have the same effect as an “against” vote on this proposal. Broker non-votes, if any, will have no effect.

Principal Accountant Fees and Services

The following table represents aggregate fees billed to the Company for the fiscal years ended December 31, 2020 and December 31, 2021 by Ernst & Young LLP, the Company’s principal accountant.

| | | | | | | | | | | |

| Fiscal Year Ended |

| 2021 | | 2020 |

| (in thousands) |

| Fee Category | | | |

| Audit fees(1) | $ | 1,580 | | $ | 1,331 |

| Audit-related fees | — | | — |

| Tax fees | — | | — |

| All other fees(2) | 2 | | 3 |

| Total fees | $ | 1,582 | | $ | 1,334 |

(1) Audit fees consist of fees for professional services provided primarily in connection with the annual audit of our financial statements, audit of our internal controls over financial reporting, quarterly reviews and services associated with SEC registration statements and other documents issued in connection with the Company’s at the market offerings, including comfort letters and consents.

(2) All other fees consist of a subscription to Ernst & Young Atlas Online, a proprietary knowledge management and research system.

All fees described above were pre-approved by the Audit Committee.

Pre-Approval Policies and Procedures.

Pursuant to its charter, the Audit Committee must review and approve, in advance, the scope and plans for the audits and the audit fees and approve in advance (or, where permitted under theapplicable rules and regulations of the SEC, subsequently) all non-audit services to be performed by the independent registered public accounting firm thatSecurities and Exchange Commission, and thus are not otherwise prohibited by law and any associated fees. The Audit Committee may delegate to one or more members of the committee the authority to pre-approve audit and permissible non-audit services, as long as this pre-approval is presented to the full committee at scheduled meetings.

The Board of Directors Recommends

A Vote “For” Proposal 5.

Proposal 6

Approval of an Adjournment of the Annual Meeting, if Necessary, to Solicit Additional Proxies

General

If the Annual Meeting is convened and a quorum is present, but there are not sufficient votes to approve Proposal 3, or if there are insufficient votes to constitute a quorum, our proxy holders may move to adjourn the Annual Meeting at that time in order to enable the Board to solicit additional proxies.

In this proposal, we are asking our stockholders to authorize the holder of any proxy solicited by the Board to vote in favor of adjourning the Annual Meeting to another time and place, if necessary or appropriate (as determined in good faith by the Board), to solicit additional proxies in the event there are not sufficient votes to approve Proposal 3. If our stockholders approve this proposal, we could adjourn the Annual Meeting and any adjourned or postponed session of the Annual Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from our stockholders that have previously voted. Among other things, approval of this proposal could mean that, even if we had received proxies representing a sufficient number of votes to defeat Proposal 3, we could adjourn the Annual Meeting without a vote on such proposal and seek to convince our stockholders to change their votes in favor of such proposal.

If it is necessary or appropriate (as determined in good faith by the Board) to adjourn the Annual Meeting, no notice of the adjourned meeting is required to be given to our stockholders, other than an announcement at the Annual Meeting of the time and place to which the Annual Meeting is adjourned, so long as the meeting is adjourned for 30 days or less and no new record date is fixed for the adjourned meeting. At the adjourned meeting, we may transact any business which might have been transacted at the original meeting.

Vote Required

Approval of this proposal requires the vote of the holders ofinclude a majority of the shares present at the Annual Meeting or represented by proxy and entitled to vote on the matter at the Annual Meeting. Abstentions will have the same effect as an “against” vote on this proposal. Broker non-votes, if any, will have no effect.

The Board of Directors Recommends

A Vote “For” Proposal 6.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the ownership of the Company’s common stock as of March 31, 2022 by: (i) each director; (ii) each of the Company’s named executive officers; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than 5% of its common stock.

The table is based upon information supplied by officers, directors and principal stockholders, Schedules 13D and 13G filed with the SEC and other sources believed to be reliable by the Company. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 143,569,902 shares outstanding on March 31, 2022, adjusted as required by rules promulgated by the SEC. The number of shares of common stock used to calculate the percentage ownership of each listed beneficial owner includes the shares of common stock underlying options or convertible securities held by such beneficial owner that are exercisable or convertible within 60 days following March 31, 2022. Unless otherwise indicated, the address for each person or entity listed in the table is c/o Allogene Therapeutics, Inc., 210 East Grand Avenue, South San Francisco, California 94080.

| | | | | | | | | | | | | | |

| Name of Beneficial Owner | | Number of shares Beneficially Owned | | Percentage Beneficially Owned |

| Greater than 5% Stockholders | | | | |

| Pfizer Inc.(1) | | 22,032,040 | | 15.3% |

| TPG GP A, LLC(2) | | 18,716,306 | | 13.0% |

| Directors and Named Executive Officers | | | | |

| David Bonderman(3) | | 18,716,306 | | 13.0% |

| Arie Belldegrun, M.D.(4) | | 8,858,860 | | 6.2% |

| David Chang, M.D., Ph.D.(5) | | 8,427,632 | | 5.9% |

| Joshua Kazam(6) | | 242,387 | | * |

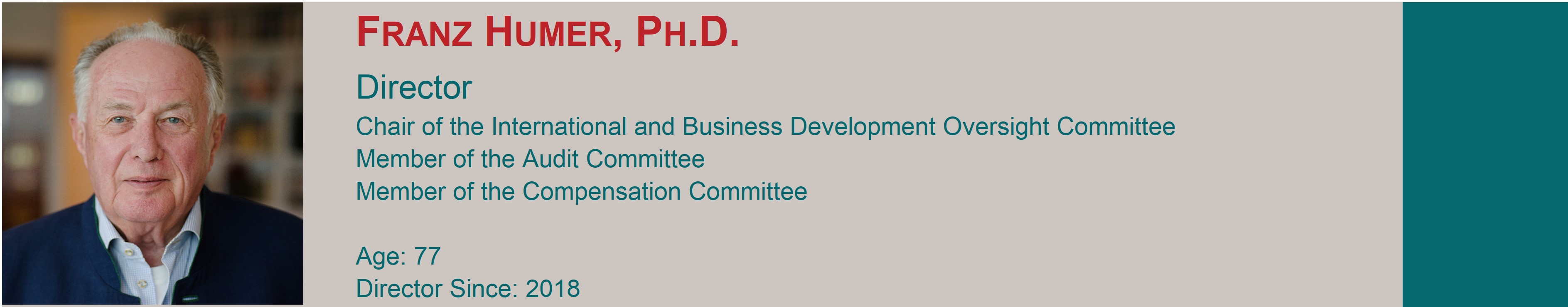

| Franz Humer, Ph.D.(7) | | 314,966 | | * |

| Deborah Messemer(8) | | 287,215 | | * |

| Owen Witte, M.D.(9) | | 275,222 | | * |

| Elizabeth Barrett(10) | | 63,385 | | * |

| Vicki Sato, Ph.D.(11) | | 34,692 | | * |

| Todd Sisitsky | | — | | | — |

| John DeYoung | | — | | | — |

| Eric Schmidt, Ph.D.(12) | | 1,846,218 | | 1.3% |

| Alison Moore, Ph.D.(13) | | 1,680,278 | | * |

| Rafael Amado, M.D.(14) | | 764,418 | | * |

| Veer Bhavnagri(15) | | 1,017,493 | | * |

| All current executive officers and directors as a group (15 persons)(16) | | 42,529,072 | | 29.8% |

* Represents beneficial ownership of less than 1%.

(1) Consists of 22,032,040 shares of common stock held by Pfizer Inc. (“Pfizer”). The address of Pfizer is 235 E. 42nd Street, New York, NY 10017. This information is based on a Form 4 filed by PF Equity Holdings 2 B.V., a wholly-owned subsidiary of Pfizer, on April 4, 2022 with the SEC.

(2) Consists of an aggregate of 18,716,306 shares of common stock. TPG GP A is the managing member of TPG Group Holdings (SBS) Advisors, LLC, a Delaware limited liability company, which is the general partner of TPG Group Holdings (SBS), L.P., a Delaware limited partnership, which holds 100% of the shares of Class B common stock (which represents a majority of the combined voting power of the common stock) of TPG Inc., a Delaware corporation (“TPG”), which is the controlling shareholder of TPG GP Co, Inc., a Delaware corporation, which is the managing member of TPG Holdings I-A, LLC, a Delaware limited liability company, which is the general partner of TPG Operating Group I, L.P., a Delaware limited partnership, which is the sole member of each of (i) TPG GenPar VII Advisors, LLC, a Delaware limited liability company and (ii) The Rise Fund GenPar Advisors, LLC, a Delaware limited liability company. TPG GenPar VII Advisors, LLC is the general partner of TPG GenPar VII, L.P., a Delaware limited partnership, which is the general partner of TPG Carthage Holdings, L.P., a Delaware limited partnership, which directly holds 12,477,536 shares of Common Stock. The Rise Fund GenPar Advisors, LLC is the general partner of The Rise Fund GenPar, L.P., a Delaware limited partnership, which it the general partner of The

Rise Fund Carthage, L.P., a Delaware limited partnership (together with TPG Carthage Holdings, L.P., the “TPG Funds”), which directly holds 6,238,770 shares of Common Stock. Because of TPG GP A’s relationship with the TPG Funds, TPG GP A may be deemed to beneficially own the shares of Common Stock held by the TPG Funds. TPG GP A is owned by entities owned by Messrs. Bonderman, Coulter and Winkelried. Because of the relationship of Messrs. Bonderman, Coulter and Winkelried to TPG GP A, each of Messrs. Bonderman, Coulter and Winkelried may be deemed to beneficially own the shares of Common Stock held by the TPG Funds. Messrs. Bonderman, Coulter and Winkelried disclaim beneficial ownership of the shares of Common Stock held by the TPG Funds except to the extent of their pecuniary interest therein. The address of each of the TPG Funds is c/o TPG Global, LLC, 301 Commerce Street, Suite 3300, Fort Worth, Texas 76102. This information is based on the Schedule 13D/A filed on January 18, 2022 with the SEC.

(3) Consists of the shares described in note (2) above.

(4) Consists of (i) 4,710,120 shares of common stock beneficially owned by Rebecka Belldegrun, as beneficiary and trustee of the Bellco Legacy Trust fbo Rebecka Belldegrun, (ii) 195,039 shares of common stock beneficially owned by Bellco Legacy LLC, of which Dr. Belldegrun is a manager, (iii) 1,798,163 shares of common stock beneficially owned by Vida Ventures LLC (“Vida”), of which VV Manager LLC is the manager, of which Dr. Belldegrun is a Senior Managing Director, (iv) 302,849 shares of common stock held by Dr. Belldegrun, 173,739 of which will be subject to our right of repurchase as of 60 days of March 31, 2022, and (v) 1,852,689 shares of common stock issuable upon exercise of options,1,640,103 of which will be unvested but exercisable within 60 days of March 31, 2022 held by Dr. Belldegrun. Dr. Belldegrun disclaims beneficial ownership of the shares held by Vida, except to the extent of any pecuniary interest therein. The address of Dr. Belldegrun, Bellco Legacy Trust and Bellco Legacy LLC is 2049 Century Park East, Suite 1940 Los Angeles, CA 90067. The address of Vida is 40 Broad Street, #201, Boston, MA 02109.

(5) Consists of (i) 2,186,198 shares of common stock held by David Chang, M.D., Ph.D., 10,191 of which will be subject to our right of repurchase as of 60 days of March 31, 2022, (ii) 1,201,108 shares of common stock held by the Chang 2006 Family Trust (“Chang Trust”), (iii) 856,044 shares of common stock held by the JEC 2019 Trust, (iv) 856,044 shares of common stock held by the RTC 2019 Trust, and (v) 3,328,238 shares of common stock issuable upon exercise of options, 2,718,587 of which will be unvested but exercisable within 60 days of March 31, 2022. Dr. Chang is co-trustee of the Chang Trust, JEC 2019 Trust and RTC 2019 Trust.

(6) Consists of 242,387 shares of common stock held by Joshua Kazam.

(7) Consists of (i) 131,216 shares of common stock held by Franz Humer, Ph.D. and (ii) 183,750 shares of common stock issuable upon exercise of options.

(8) Consists of (i) 6,535 shares of common stock held by the Messemer Family Trust (“Messemer Trust”) and (ii) 280,680 shares of common stock issuable upon exercise of options, 19,836 of which will be unvested but exercisable within 60 days of March 31, 2022. Ms. Messemer is trustee of the Messemer Trust.

(9) Consists of (i) 221,182 shares of common stock held by Owen Witte, M.D., and (ii) 54,040 shares of common stock issuable upon exercise of options, 2,335 of which will be unvested but exercisable within 60 days of March 31, 2022.

(10) Consists of 63,385 shares of common stock issuable upon exercise of options.

(11) Consists of 34,692 shares of common stock issuable upon exercise of options.

(12) Consists of (i) 54,466 shares of common stock held by Eric Schmidt, Ph.D., (ii) 1,152,595 shares of common stock held by the Eric Schmidt 2017 Family Irrevocable Trust (“Schmidt Trust”), which were acquired by the Schmidt Trust upon the exercise of stock options held by Dr. Schmidt, 40,707 of which will be subject to our right of repurchase as of 60 days of March 31, 2022, and (iii) 639,157 shares of common stock issuable upon exercise of options, 491,455 of which will be unvested but exercisable within 60 days of March 31, 2022. Dr. Schmidt’s spouse is trustee of the Schmidt Trust.

(13) Consists of (i) 77,675 shares of common stock held by Alison Moore, Ph.D., and (ii) 1,602,603 shares of common stock issuable upon exercise of options, 888,831 of which will be unvested but exercisable within 60 days of March 31, 2022.

(14) Consists of (i) 33,234 shares of common stock held by Rafael Amado, M.D., and (ii) 731,184 shares of common stock issuable upon exercise of options, 537,793 of which will be unvested but exercisable within 60 days of March 31, 2022.

(15) Consists of (i) 371,589 shares of common stock held by Veer Bhavnagri, and (ii) 645,904 shares of common stock issuable upon exercise of options, 394,382 of which will be unvested but exercisable within 60 days of March 31, 2022.

(16) Includes the shares described in notes (3) through (15) above.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2021, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with, other than one late Form 4 filing reporting two transactions for Dr. Chang.

Executive Compensation

Compensation Discussion and Analysis in this Proxy Statement. However, we believe providing additional disclosure regarding our compensation philosophy, policies and principles underlying our executive compensation decisions constitutes good corporate governance and provides our stockholders with valuable information regarding our executive compensation practices. In particular, this Discussion of Named Executive Officer Compensation is designed to provide you with a better understanding of our compensation philosophy and how our Compensation Committee makes decisions regarding compensation for our named executive officers listed below.

Overview

This Compensation Discussion and Analysisof Named Executive Officer Compensation discusses the compensation philosophy, policies and principles underlying our executive compensation decisions for 2021.2023. It provides qualitative information on the factors relevant to these decisions and the manner in which compensation is awarded to our named executive officers (our “Named Executive Officers” or “NEOs”) for the fiscal year ended December 31, 2021,2023, which consist of our principal executive officer principal financial officer and our remaining threethe Company’s two other most highly compensated executive officers during 2021.2023. Our Named Executive Officers for 20212023 were:

•David Chang, M.D., Ph.D., our President and Chief Executive Officer;

•Eric Schmidt, Ph.D.,Timothy Moore, our Executive Vice President, Chief FinancialTechnical Officer; and

•Rafael Amado,Zachary Roberts, M.D., Ph.D. our Chief Medical Officer and Executive Vice President, Research and Development;Development and Chief Medical Officer.

•Alison Moore, Ph.D.,

Corporate Highlights for 2023

The Compensation Committee, in consultation with the Board, is responsible for establishing, implementing, and overseeing our Chief Technical Officer;overall compensation strategy and

•Veer Bhavnagri, policies, including our General Counsel.

Executive Summary

2021 Business Highlights. During 2021, we achieved several importantexecutive compensation program, in a manner that supports our business milestones, including, but not limitedobjectives. Our Compensation Committee determined that in 2023 the Company continued to the following:

•Advanced our innovative pipeline:

o Continued enrollment in the Phase 1 clinical trial ("ALPHA trial") of ALLO-501 in patients with relapsed/refractory non-Hodgkin lymphoma (“NHL”), the Phase 1/2 clinical trial ("ALPHA2 trial") of ALLO-501A in patients with relapsed/refractory NHL, and in the Phase 1 clinical trial ("UNIVERSAL trial") of ALLO-715 in patients with relapsed/refractory multiple myeloma. In addition, in the first half of 2021, we expanded the UNIVERSAL trial to assess ALLO-715 in combination with SpringWorks Therapeutics, Inc.’s investigational gamma secretase inhibitor, nirogacestat.

o Reported interim data for the ALPHA, ALPHA2 and UNIVERSAL trials at the American Society of Hematology ("ASH") annual meeting in December 2021, providing continued proof-of-concept ofadvance its allogeneicchimeric antigen receptor (“CAR”(“CAR”)T cell therapy in blood cancers.

o Advanceddevelopment programs, however 2023 became a transition year with respect to both our anti-CD70 CAR T cell product candidate, ALLO-316, that may have potential for various hematologic and solid tumor indications. In the first half of 2021, we initiated a Phase 1 clinical trial of ALLO-316 in patients with advanced or metastatic clear cell renal cell carcinoma.

o Progressed our technology platform that we call “TurboCARs” to mimic cytokine activation signaling within a CAR T cell, which could enhance the proliferative potential, migratory behavior, and killing activity of cells. In mid-2021, we initiated a Phase 1 clinical trial of our first TurboCAR, ALLO-605, in patients with relapsed/refractory multiple myeloma.

o Obtained FDA designations for advancing thekey development or any commercialization of our product candidates, including Fast-Track designation for ALLO-605, Regenerative Medicine Advanced Therapy designation for ALLO-715 and Orphan Drug Designation for ALLO-715.

•Further built-out our capabilities:

o Advanced Allogene Overland Biopharm (CY) Limited, our joint venture with Overland Pharmaceuticals (CY) Inc. for the development, manufacturing and commercialization of certain of our product candidates targeting BCMA, CD70, FLT3, and DLL3 in China, Taiwan, South Korea and Singapore. In 2021, we hired a new chief executive officer, leased a facility for manufacturing and began technology transfer for manufacturing.

o Initiated GMP manufacturing from our cell therapy manufacturing facility in Newark, California.

o Entered into a lease agreement to expand our headquarters in South San Francisco, California. The lease is expected to commence on April 1, 2022, and the additional 47,566 square feet of office and laboratory space will support the growth of our research platform and correlative clinical development activities.

o Strengthened our board of directors with the appointment of Ms. Barrett and Dr. Sato,programs and our scientific advisory board withexecutive leadership team.

As the appointment of Jae Park, M.D.

o Grew our organization from 264 employeesCompensation Committee performed its annual compensation review at the beginning of 2023, the year to 301 employees at the endCommittee was particularly concerned with retention of the year.

In addition to the above achievements, we overcame a significant unexpected regulatory challenge. In October 2021, the FDA placed a hold onexecutive team, particularly our clinical trials. The clinical hold followedCEO. One executive officer, our notification to the FDA of a chromosomal abnormalityExecutive Vice President, Research and Development, had resigned in an ALPHA2 trial patient which was detected in a bone marrow biopsy undertaken to assess pancytopenia. Investigations concluded that the chromosomal abnormality was unrelated to TALEN gene editing or our manufacturing processDecember 2022, and had no clinical significance. The investigation also determined that the abnormality was not detected in any of our manufactured product candidates or in any other patient treatedthese concerns materialized with the same ALLO-501A lot. The abnormality occurred in the patient after the cell product was administered and involved regionsbroader turnover of the T cell receptor and immunoglobulin genes known to undergo rearrangement as part of the T cell or B cell maturation process. The FDA found that we satisfactorily addressed all clinical hold issues and removed the hold in January 2022. The Compensation Committee and the Board refrained from rewarding any additional compensation during the clinical hold and approved the 2021 annual incentive bonus and 2022 base salary adjustments after the clinical hold was resolved in January 2022.

We believe the achievements highlighted above as well as resolving the clinical hold were a result of exceptional strategic, technical and operational leadership.

2021 Executive Compensation Policies and Practices. During 2021, our executive compensation policies and practices included the following:

•Compensation Committee of Independent Directors. The Compensation Committee is composed of all independent directors and includes our lead independent director.

•Annual Compensation Review. The Compensation Committee undertakes a comprehensive review of compensation of our senior vice presidents and above, including our Named Executive Officers, on an annual basis.

•Independent Compensation Consultant. The Compensation Committee engages its own compensation consultant, and reviews its independence from management.

•Risk Analysis. We review the structure of our executive compensation program to minimize the risk of inappropriate risk-taking by our executive officers.

•No Guaranteed Compensation. Although we have signed employment agreements with each of our Named Executive Officers, these agreements provide for “at will” employment, and none of these agreements provides any guarantees relating to base salary increases or the amounts of any annual incentive awards or long-term equity awards.

•Multi-Year Vesting. The equity awards granted to our executive officers generally vest over multi-year periods, consistent with current market practice and our retention objectives.

•No Special Retirement Benefits. We do not provide pension arrangements or post-retirement health coverage for our executive officers or employees. Our executive officers and other U.S.-based employees are eligible to participate in our Section 401(k) plan, which is a retirement savings defined contribution plan established in accordance with Section 401(a) of the Internal Revenue Code of 1986 (the “Code”). We currently make matching contributions into the Section 401(k) plan on behalf of participants. We match 100% of eligible contributions up to the first 3% of eligible compensation, with an additional match of 50% on the next 3% (maximum of 4.5%).

•No Special Health or Welfare Benefits or Perquisites. Our executive officers participate in broad-based company-sponsored health and welfare benefits programs on the same basis as our other full-time, salaried employees. We generally do not provide perquisites or other personal benefits to our executive officers, other than those we provide to our employees generally.

•No Tax Reimbursements. We do not provide any tax reimbursement payments (including “gross-ups”) on any perquisites or other personal benefits.

•Policy Against Hedging and Speculative Trading and Pledging our Common Stock. Our insider trading policy prohibits our employees from engaging in “hedging” or other inherently speculative transactions with respect to our common stock or borrowing against our common stock. Specifically, no officer, director, other employee or consultant may engage in short sales, transactions in put or call options, hedging transactions or other inherently speculative transactions with respect to our

common stock at any time. In addition, no officer, director, other employee or consultant may margin, or make any offer to margin, or otherwise pledge as security, any of our common stock, including without limitation, borrowing against such stock, at any time.

•Stock Ownership Guidelines Policy.CEO, during 2023. The purpose of our Stock Ownership Guidelines Policy is to encourage ownership of our common stock, promote the alignmentCompensation Committee was of the long-term interests of our non-employee directors, Chief Executive Officer, and other executive officers with the long-term interests of our stockholders, and further promote our commitment to sound corporate governance. Under the Guidelines, the target stock ownership level for our President and Chief Executive Officer is six times (6x) his base annual salary, the target stock ownership level for our non-employee directors is five times (5x) their base annual cash retainer and the target stock ownership level for our other executive officers is one times (1x) their base annual salary. Under these Guidelines, the compliance deadline for all of our executive officers and directors is the later of December 2023 and five years from an individual's commencement of employment or appointment to our Board, although we expectview that the target stock ownership levels likely willoutstanding equity grants held by the executive team would not be achieved much sooner than that.

2021 Executive Compensation Highlights. Despite the challenge of the clinical hold, we made significant progress towards critical clinical, research, manufacturing, and other strategic milestones,effective as described above. With respect to 2021 compensation decisions, the Compensation Committee and our Board focused on ensuring thata retention tool or as performance incentives, because a significant portion of the total directoutstanding stock grants were “underwater, ” meaning that the stock option exercise price exceeded the market price of our common stock. As such, the Compensation Committee was concerned that the outstanding stock option grants would provide little or no perceived value to the option holders. In an effort to balance stockholders’ general desire for a performance-oriented compensation awardedstructure with the need to incentivize and retain the executive team, the Compensation Committee added performance stock units (“PSUs”) as part of its annual equity grants for 2023. See the discussion below under heading “Executive Compensation—Executive Compensation Program and Compensation Decisions for the Named Executive Officers—Long-Term Incentive Compensation”).

Despite the transitions in our management team, throughout 2023 we continued to execute the Company’s most advanced clinical trial programs, ALPHA2 and EXPAND. In late 2023, the work done to advance our lead product candidate, cemacabtagene ansegedleucel (“cema-cel,” previously ALLO-501A) into a first line (“1L”) consolidation trial (“ALPHA3”) came to fruition and accordingly, afforded the management team the opportunity to reassess the Company’s development strategy to make the long-term commercial prospect more competitive. The management team recognized that the outcome of ALPHA3 could allow cema-cel to be embedded in the 1L setting as a consolidation treatment to boost cure rates. We believe this may redefine the future of CAR T therapy and potentially reposition our allogeneic CAR T

product as the only CAR T to be part of a 1L treatment plan for newly diagnosed and treated large B-cell lymphoma (“LBCL”) patients. This could greatly enhance cema-cel’s market opportunity by competitively placing use of cema-cel ahead of other CAR T therapies and potentially rendering later-line treatment (including those being investigated in ALPHA2 and EXPAND) obsolete. As a result, the Company made the decision to deprioritize ALPHA2 and EXPAND in the third line (“3L”) setting, and focus on ALPHA3.

Following our 2023 reprioritization, earlier this year we announced our 2024 Platform Vision, under which we are focusing on four core programs:

•Large B-Cell Lymphoma (LBCL): Potentially groundbreaking ALPHA3 Trial that we believe may leapfrog other CAR T’s and embed cema-cel in 1L LBCL treatment in community cancer centers where most newly diagnosed patients seek care.

•Chronic Lymphocytic Leukemia (CLL): New Phase 1 ALPHA2 Cohort is designed to evaluate cema-cel as a CLL treatment to address the limitations of autologous therapies in a disease where poor T cell fitness is a known barrier to efficacy.

•Autoimmune Disease (AID): ALLO-329, our next-generation CD19 Dagger® program, focuses on scalability and reduced or chemotherapy-free lymphodepletion, positioning allogeneic CAR T to potentially transform autoimmune management and meet the demand of the market.

•Renal Cell Carcinoma (RCC): Ongoing TRAVERSE trial with ALLO-316 seeks to advance scientific innovation underlying the Dagger® technology to optimize CAR T cell expansion and persistence, thereby maximizing the potential of allogeneic CAR T in solid tumors while mitigating treatment-associated inflammatory response.

Compensation Highlights for 2023

In view of the deprioritization of ALPHA2 and EXPAND, a large percentage of the Company’s corporate goals for 2023 could not be fully achieved. Because our Compensation Committee adheres to a longstanding pay-for-performance philosophy, the failure to fully achieve such goals is reflected in the Compensation Committee’s relatively low scoring of the corporate goals resulting in an achievement level of 57.5%. A general description of the 2023 milestones in support of the Company’s business strategy and this conclusion by the Compensation Committee are described below under the heading “Annual Cash Incentive Plan.”

The Compensation Committee evaluates our compensation program, taking into consideration best practices and emerging trends, stockholder input as well as data and feedback provided by our independent executive compensation consultant, Compensia. In the past year, we have continued to take measures to align our compensation program with stockholder interests including the following actions:

•In 2023, excluding Dr. Chang, our Named Executive Officers was performance-based and linked to meeting our long-term strategic plan to create long-term stockholder value.Officer’s base salaries comprised approximately 6% of their total compensation, on an aggregate basis. Dr. Chang’s 2023 base salary represented approximately 5% of his total compensation.

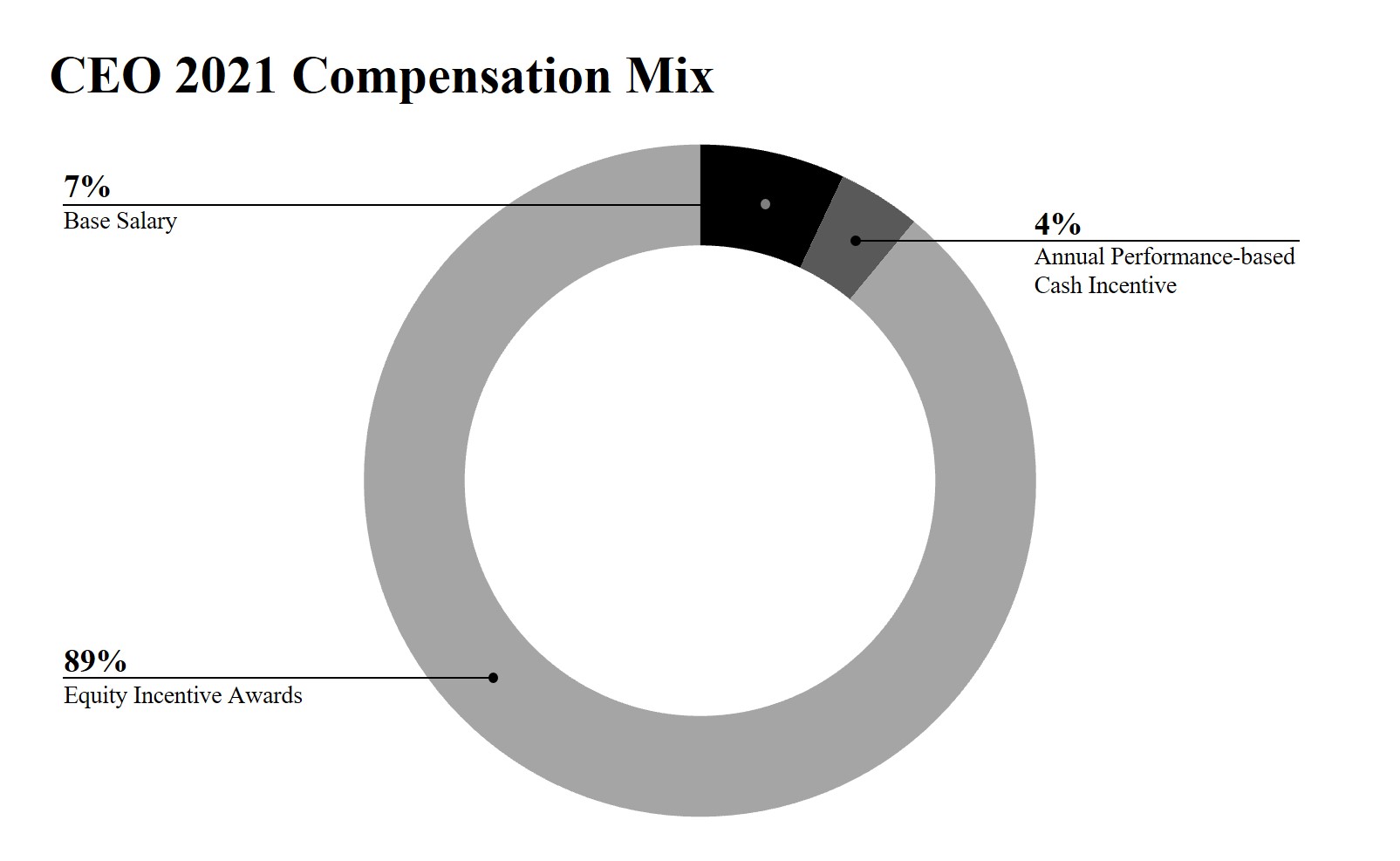

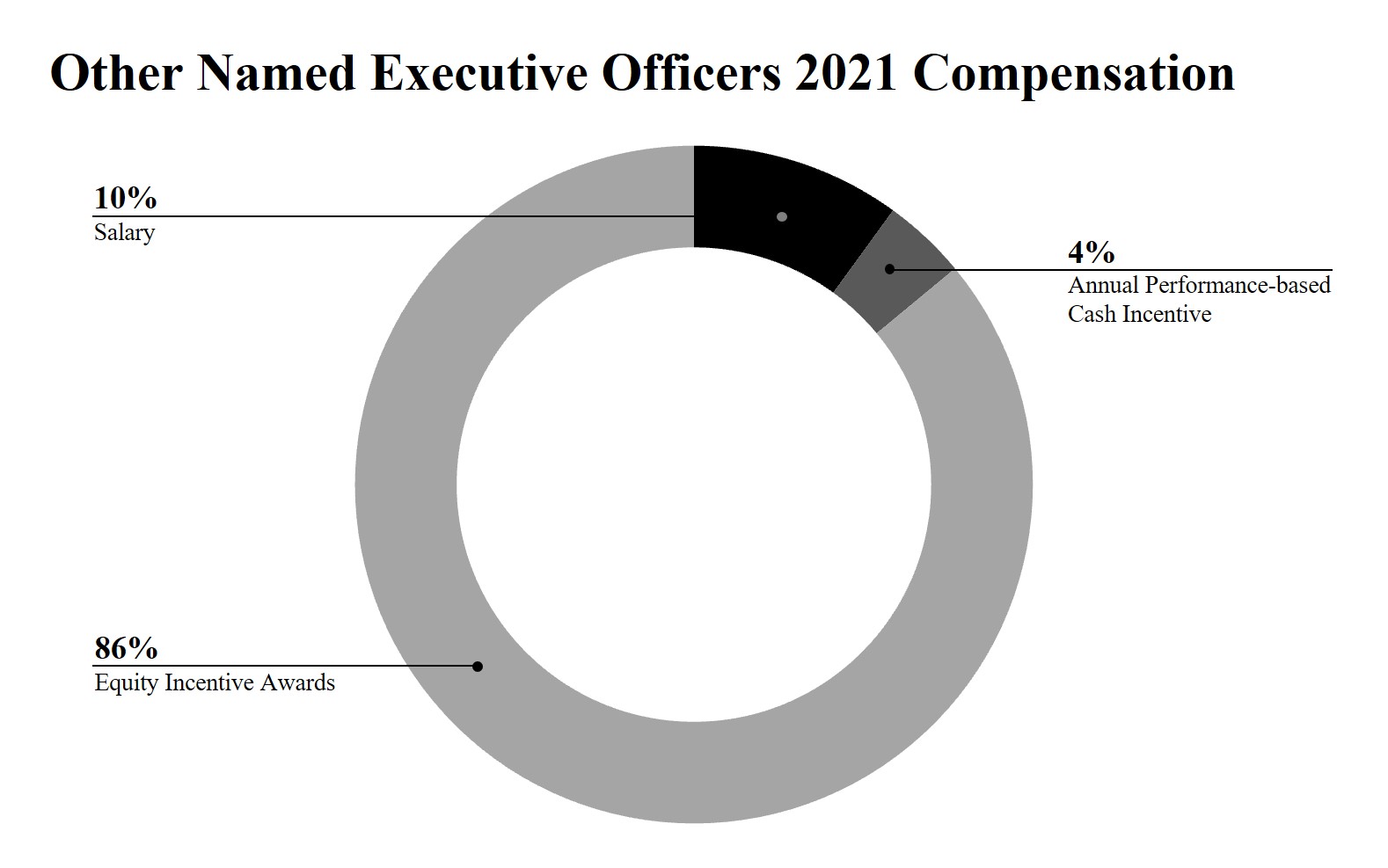

The substantial

•A large majority of our 2021 compensation to Named Executive OfficersOfficers’ compensation was represented by long-term incentives, which are inherently performance based. Approximately 93% of Dr. Chang’s total compensation for 2023 was in the form of equity incentive awards. We believe that equity incentive awards further our long-term strategic plan to create long-term stockholder value. In recognition of our significant achievements and as a retention measure, the Compensation Committee also granted 2021 annual equity awards to Dr. Schmidt, Dr. Amado, Dr. Moore and Mr. Bhavnagri and our Board granted 2021 annual equity awards to Dr. Chang. The following charts illustrate the portion of compensation attributable to equity incentive awards, annual performance-based cash incentive awards and base salary for our Chief Executive Officer and forincentives. For our other Named Executive Officers, on average, approximately 91% of their total compensation for 2023 was represented by long-term incentives.

•For 2023 annual long-term incentives, in March 2023 the Compensation Committee determined that Dr. Chang, along with all the executive officers serving at that time, except for Dr. Roberts, would receive 35% of the target dollar value in stock options, 15% in restricted stock units (“RSUs”), and 50% in performance stock units (“PSUs”). As described in more detail below, Dr. Roberts was given a pro-rated PSU award since he joined the Company in January 2023.

The graphs above display the base salary, cash incentive, long-term incentives (stock option grant date fair value, RSU grant date fair value and PSU grant date fair value) of our Chief Executive Officer, Dr. Chang (left chart) and other NEOs (Dr. Roberts and Mr. Moore) (right chart). Because Dr. Roberts and Mr. Moore both started with the Company in 2023, their compensation mix shown in the chart above includes new hire grants, sign-on bonuses and other compensation, each as reported in the Summary Compensation Table. As a result, their equity compensation mix differs significantly from our CEO’s equity compensation mix as reflected in the charts above. The target dollar value used by the Compensation Committee in establishing market-based PSU grants (i.e., PSUs wherein the vesting performance measure is based on achieving a target Allogene stock price) differs from the grant date fair value calculated under FASB ASC Topic 718 in which the value is discounted using the Monte Carlo simulation. The values reflected in the graphs above and the compensation tables below reflect the grant date fair values.

Executive Compensation Governance Practices

Below we summarize certain executive compensation related governance practices that we follow and that we believe serve our stockholders’ long-term interests.

| | | | | |

| WHAT WE DO |

| ✓ | DO maintain an executive compensation program designed to align pay with performance |

| ✓ | DO conduct an annual say on pay advisory vote |

| ✓ | DOalign pay and performance with a significant percentage of total compensation linked to the achievement of Company operational and strategic goals established at the beginning of the performance period by the Compensation Committee, and in the case of NEOs other than the CEO, individual performance, and contribution in achieving the Company goals |

| ✓ | DO maintain a Compensation Committee comprised solely of independent directors |

| ✓ | DOhave double trigger on executive change in control severance arrangements |

| ✓ | DOprohibit speculative trading of company stock (short sales, put or call options, hedging transactions, etc.) |

| ✓ | DO prohibit pledging or the use of common stock to secure a margin or other loan |

| ✓ | DO retain an independent compensation consultant |

| ✓ | DOmaintain stock ownership guidelines for executives and directors |

| ✓ | DOmaintain an executive officer recoupment (“claw back”) policy |

| ✓ | DOconduct an annual comprehensive compensation program risk assessment |

| ✓ | DO evaluate officer compensation levels against a peer group of similarly situated companies |

| ✓ | DO annual comprehensive review of compensation of our senior vice presidents and above, including our NEOs |

| ✓ | DOrequire equity awards granted to our executive officers vest over multi-year periods or vest based on the achievement of key strategic goals |

| | | | | |

| WHAT WE DO NOT DO |

| ✘ | NO incentives that may motivate excessive risk-taking or present a windfall risk |

| ✘ | NO pay decisions that circumvent pay-for-performance, such as options backdating or waiving performance requirements for performance stock units |

| ✘ | NO repricing or replacing of underwater stock options/SARs without prior shareholder approval (including cash buyouts and voluntary surrender of underwater options) |

| ✘ | NO agreements providing for tax gross-ups for any employee or director |

| ✘ | NO material perquisites |

| ✘ | NO excessive termination or CIC severance payments (2 years or less) |

| ✘ | NO executive single-trigger change in control benefits |

| ✘ | NO severance payments or benefits for executives who voluntarily terminate their employment |

| ✘ | NOguaranteed compensation and all executives are employed “at will” |

| ✘ | NO guaranteed annual bonus payouts |

| ✘ | NO benefits for our executives not generally available for all employees |

| ✘ | NO granting of in-the-money stock options |

“Say on Pay” Consideration

At our 2023 annual meeting of stockholders, approximately 68.4% of the shares voted at the meeting (exclusive of broker non-votes) were voted in favor of the approval, on an advisory basis, of the compensation of our named executive officers as disclosed in the proxy statement for that annual meeting. In light of the prior year’s say on pay results (93% in June 2022), we were disappointed by the 2023 results. The Compensation Committee considered this support carefully, and took the following meaningful steps in direct response to the 2023 say on pay voting results:

•Significantly reduced the grant date fair value of the CEO’s and Executive Chair’s January 2024 annual equity grants to approximately 26% of the 2023 grant date fair value.

•Implemented no base salary increase in 2024 for the CEO and the Executive Chair (for the second consecutive year) and approved only a modest adjustment (1%) for one of the remaining NEOs to bring his base compensation in line with approximately the 50th percentile of our peer group.

•The level of stockholder support was also a significant factor in the Company’s decision to voluntarily provide the additional disclosure included in this Discussion of Named Executive Officer Compensation to ensure greater transparency, although not required as a group.Smaller Reporting Company, which includes:

◦More detailed disclosure regarding how the Compensation Committee, in consultation with its independent compensation consultant, set the Executive Chair’s compensation (see disclosure below under the heading “Executive Compensation—Executive Chair Compensation”), and more detailed disclosure regarding the Executive Chair’s role, responsibilities and contributions to the Company which we believe provide a compelling rationale in support of his compensation (see disclosure above under the heading “Information Regarding the Board of Directors and Corporate Governance—Board Leadership Structure”); and

◦Detailed disclosure regarding the 2023 equity grants, which included a mix of options, RSUs and PSUs, and disclosure regarding how the Compensation Committee used PSUs with aggressive vesting events (over 350% increase in share price and product regulatory approval targets) in order to directly align executive compensation with creating long-term stockholder value (see disclosure below under the heading “Executive Compensation Program and Compensation Decisions for the Named Executive Officer—Long-Term Incentive Compensation”).

In addition, the Compensation Committee considered that the absence of performance-based equity awards in our 2022 executive compensation programs as described in last year’s proxy statement may have been a significant consideration for those stockholders who did not support last year’s say on pay. The Compensation Committee believes the introduction of PSUs during 2023, in addition to stock options and RSUs, addresses this concern. As discussed in greater detail below,

in structuring the Company’s 2023 equity grants to executives, the Compensation Committee sought to balance critical retention needs with the performance-based expectations of investors while focusing management on the creation of long-term shareholder value. This was done through the inclusion of PSUs in the equity mix granted for 2023, in addition to stock options, both of which the Compensation Committee views as performance-oriented, and RSUs which the Committee views as geared more towards retention.

The Compensation Committee will monitor and continually evaluate our compensation program going forward in light of our stockholders’ views and our transforming business needs. Our Compensation Committee expects to continue to consider the outcome of our say on pay votes and our stockholders’ views when making future compensation decisions for our NEOs.

Executive Compensation Philosophy and Overview

We are a clinical-stage biotechnology company pioneering the development of allogeneic CAR T cell (AlloCAR T™) products for cancer and autoimmune disease. We operate in a very technical, highly regulated, and extremely competitive industry where our long-term success is highly dependent on the specialized skills, talent, and dedication of our executive officers. Our Compensation Committee believes that a well-designed compensation program should align executive interests with the drivers of growth and stockholder return, while enabling us to attract and retain employees whose talents, expertise, leadership, and contributions are critical to building and sustaining growth in long-term stockholder value. As a result, we utilize a strong pay-for-performance compensation philosophy, with total compensation levels for our executive officers, including our NEOs, correlated to the achievement of corporate goals and individual performance, and calibrated to our peers with whom we compete for talent.

Our executive compensation program is intended to meet five principal objectives:

•Enable us to attract, retain and motivate superior talent;

•Link rewards to the achievement of critical strategic priorities;

•Create incentives for our executive officers to further our long-term strategic plan to create long-term stockholder value;

•Provide appropriate levels of risk and reward relative to an executive officer's position with us; and

•Differentiate compensation based on individual performance.

Based on this philosophy, our performance-driven compensation program primarily consists of three components: base salary, annual cash bonusincentive opportunity, and long-term incentive compensation in the form of equity awards. The Compensation Committee has determined that these three components, with a portionthe vast majority of target total direct compensation allocated to “at-risk” performance-based incentives through the use of short-term and long-term incentive compensation, best align the interests of our executive officers with those of our stockholders. While it does not have any formal policies for allocating compensation among the three components, the

Compensation Committee reviews relevant competitive market data and uses its judgment to determine the appropriate level and mix of compensation on an annual basis to ensure that compensation levels and opportunities are competitive and that we are able to attract and retain capable executive officers to work for our long-term prosperity and stockholder value, without taking unnecessary or excessive risks.

2023 Summary Compensation Table

The following table sets forth all of the compensation awarded to, earned by or paid to our Named Executive Officers during the fiscal years ended December 31, 2023, December 31, 2022 and December 31, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and principal position | | Year | | Salary ($) | | Bonus ($)(1) | | Stock awards ($)(2) | | Option awards ($)(3) | | Non-equity incentive plan compensation ($)(4) | | All other compensation ($)(5) | | Total ($) |

| David Chang, M.D., Ph.D. | | 2023 | | 724,000 | | — | | 7,996,888 | | 5,070,365 | | 270,595 | | — | | 14,061,848 |

| President and Chief Executive Officer | | 2022 | | 724,000 | | — | | — | | 13,697,357 | | 376,480 | | — | | 14,797,837 |

| | 2021 | | 695,000 | | — | | 2,717,669 | | 6,352,635 | | 396,150 | | — | | 10,161,454 |

Timothy Moore Chief Technology Officer | | 2023 | | 360,938 | | 100,000 | | 2,249,987 | | 2,999,886 | | 93,416 | | — | | 5,804,227 |

Zachary J. Roberts M.D., Ph.D. Chief Medical Officer and Executive Vice President of Research and Development | | 2023 | | 522,813 | | 75,000 | | 3,533,710 | | 3,850,445 | | 134,727 | | 14,850 | | 8,131,545 |

(1) The dollar amounts in this column reflect the sign-on bonuses paid to Dr. Roberts and Mr. Moore in 2023.

(2) The dollar amounts in this column reflect the aggregate grant date fair value of RSUs and PSUs granted during the indicated year and computed in accordance with FASB ASC 718. The grant date fair value of the 2023 RSUs is based on the closing market price of the Company’s common stock on the date of grant. The grant date fair value of the 2023 PSUs is determined using Monte Carlo simulation for PSUs that vest upon achievement of a market condition. For PSUs that vest upon achievement of a performance condition, the grant date fair value is based upon the probable outcome of such condition. Assuming that maximum performance is achieved, the value of the PSUs with performance conditions granted to Dr. Chang, Mr. Moor and Dr. Roberts in 2023 would have been $3,730,502, $1,249,991 and $1,749,858, respectively, at the date of grant under FASB ASC 718. For a discussion of valuation assumptions, see Note 10 “Stock-based Compensation” to our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023.

(3) The dollar amounts in this column represent the aggregate grant date fair value of stock option awards granted during the indicated year. These amounts have been computed in accordance with FASB ASC Topic 718, using the Black-Scholes option pricing model. For a discussion of valuation assumptions, see Note 10 “Stock-based Compensation” to our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023. These amounts do not reflect the actual economic value that will be realized by the Named Executive Officer upon the vesting of the stock options, the exercise of the stock options, or the sale of the common stock underlying such stock options.

(4) The dollar amounts in this column represent annual performance-based incentive earned for the indicated year. For more information, see above under “2023 Performance-Based Cash Incentive.”

(5) The dollar amounts in this column represent Section 401(k) Company contributions for Dr. Roberts in 2023.

Narrative to Summary Compensation Table

Process for Setting Executive Compensation